4th Quarter 2015/1st Quarter 2016 Business Conditions Survey Results Show Neutral Outlook

(South Burlington, Vt.) Today, Lisa Ventriss, President of Vermont Business Roundtable (VBR) and Jeffrey Carr, President, Economic & Policy Resources (EPR), announced the Q4 2015/Q1 2016 results of their joint initiative, the VBR-EPR Business Conditions Survey.

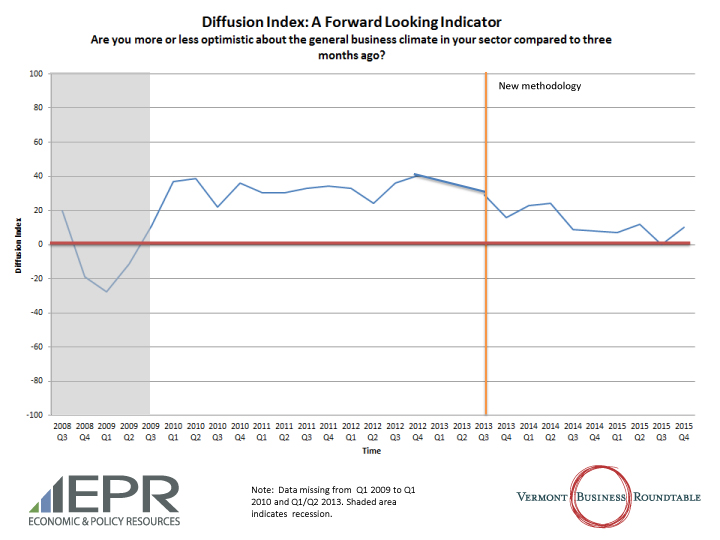

The survey, which is conducted quarterly, provides both a look back at the previous quarter and a predictive index going forward. The data for both the backward and forward-looking questions are weighted to the Vermont economy by sector employment and turned into “diffusion indices”.[1] These diffusion indices provide a tool for analyzing and presenting insight into the Vermont economy over time through the sentiments of the Roundtable members.

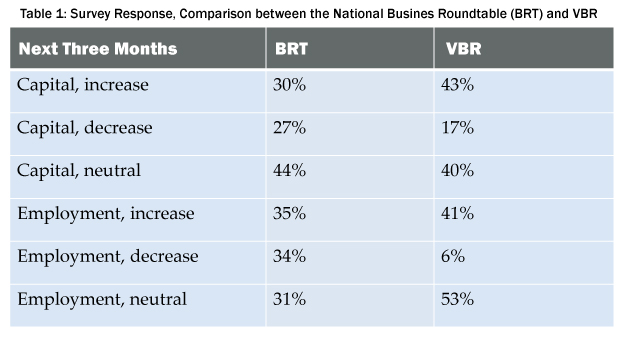

The raw survey data can be easily compared to the national Business Roundtable CEO Survey, a quarterly survey of national and multi-national companies, which contains similar questions to the VBR/EPR Survey in terms of employment and capital spending. Comparing these two surveys revealed that Vermont companies expect a greater degree of employment stability than national companies, while both national and Vermont business expected a similar degree of capital spending.

1 Each question on the survey is weighted by sector employment and the diffusion number is formulated by giving each “strong positive” answer a numerical value of 1.0, “mild positive” answers a numerical value of 0.5, neutral answers a value of 0, “mild negative” answers a value of -0.5, and strong negative values of -1.0. The diffusion index numbers are then formulated based on these numerical values. A value of 100 would mean that every respondent answered “strong positive”, a value of 0 would mean that every respondent answered neutrally, and a value of -100 would mean that every respondent answered “strong negatively.”

The latest survey, which was conducted during the first two weeks of January 2016, achieved a response rate of 76 percent overall and included a 50 percent or greater response rate from all but two sectors within the membership. The survey asked eight retrospective and prospective questions about the CEOs’ economic outlook, demand, capital spending, and employment. Survey results show that:

The latest survey, which was conducted during the first two weeks of January 2016, achieved a response rate of 76 percent overall and included a 50 percent or greater response rate from all but two sectors within the membership. The survey asked eight retrospective and prospective questions about the CEOs’ economic outlook, demand, capital spending, and employment. Survey results show that:

- Most responses to the question about the state’s overall business climate outlook were neutral (42%). The remaining responses were evenly split between optimistic (29%) and pessimistic (29%).

- More than 60 percent of respondents (62%) shared negative outlooks specifically with ease of hiring for available positions; and,

- The construction sector had the most optimistic outlook on the general business climate, while the utilities sector had the least optimistic outlook.

“We are all acutely aware of the assets in our State, which is why we are all located here in the first place. But, we also know the significant challenges that are facing our State. In particular, the cost of living is making it increasingly unaffordable for many of my employees to stay and work here. The labor market for my ski business and other ski areas is a challenge, “said Roundtable Chair Win Smith, President of Sugarbush Resort.

Graph #1 below shows the diffusion index of overall economic outlook, which measures the level of confidence (optimism or pessimism) respondents have about different aspects of the economy based on the first question on the survey, and can range from 100 (where 100% of respondents answered “strong positive”) to -100 (where 100% of respondents answered “strong negative”).

For this reporting period, the diffusion index shows a slight upturn in optimism from Q3 2015 to Q4 2015, indicating that Vermont CEOs continue to feel neutral to mildly optimistic about the business climate for the coming three months.

Graph #1

Graph #2

Graph #2 above shows the composite index of the diffusion index points for the questions relating to demand, capital spending, and employment in the next three months. The majority of responses were neutral or mildly positive, and the index point bounced up slightly from a neutral index point of 2 last survey to a mildly positive index point of 19 this survey. The outlook remains within the range of mildly optimistic to neutral.

Also included in the survey was the opportunity for Roundtable members to express their opinions on other topics affecting their businesses. The greatest frequency of responses from members concerned high taxes and tax policies, the challenges posed by the permit process, the difficulty of finding workers, and the high cost of healthcare.

The next survey will be conducted in early March 2016.

# # #

These survey results will be discussed further on VBR & EPR’s upcoming Roundtable Today! segment. Roundtable Today Q1 2016 Q4 2015 Presentation.